ESG assets are on a path to exceed $53 trillion globally by 2025, which would represent more than a third of the expected $141 trillion of global assets under management. Although the EU and US are starting to develop and adopt regulations, they are still years away until robust ESG standards and policies are enforced in the financial sector. Consequently, investors will need to keep ESG asset managers and funds accountable for tracking and reporting their investments’ actual climate impact.

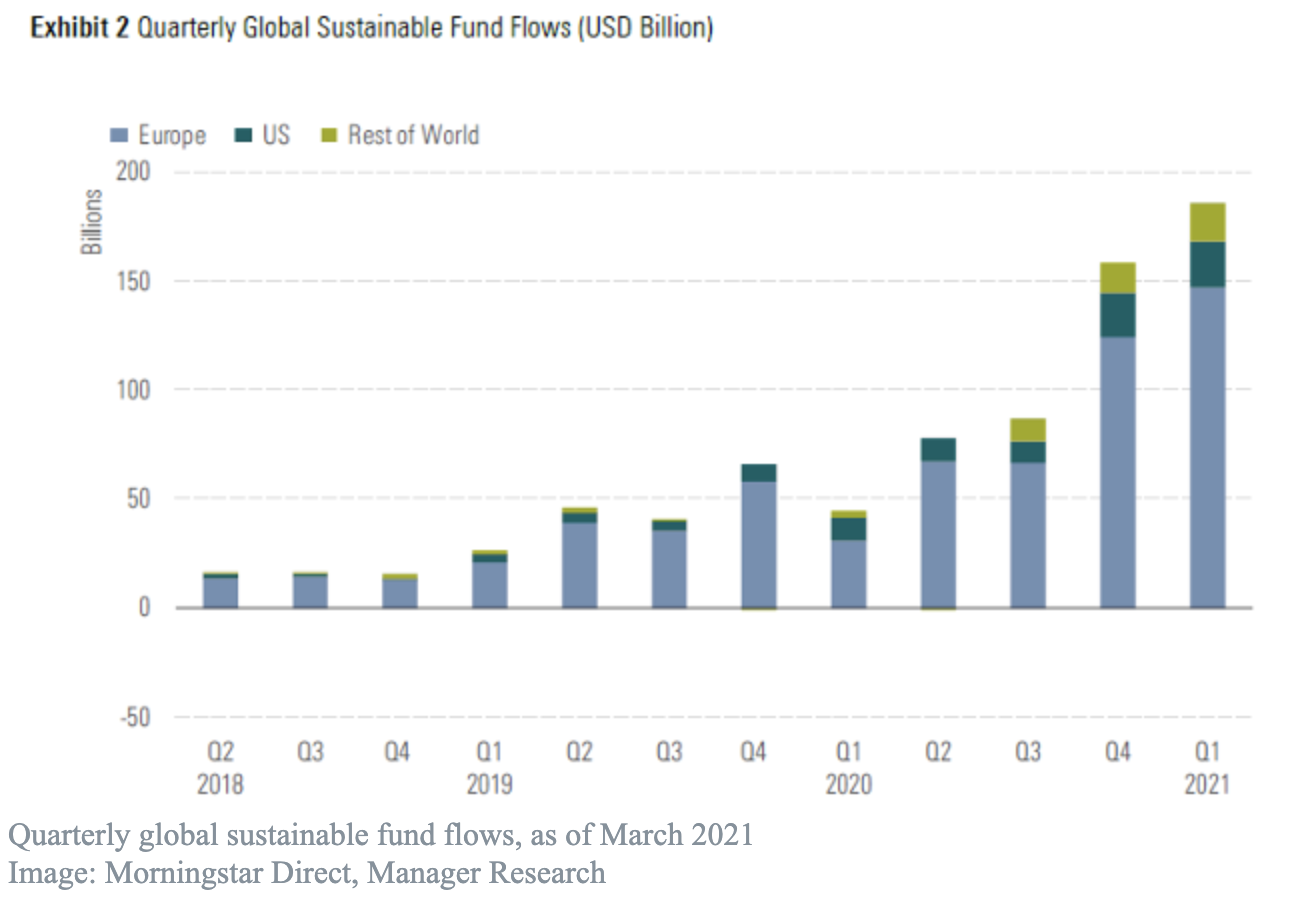

In the first quarter of 2021, global sustainable funds attracted $185.3 billion, up 17% from the prior quarter according to Morningstar – with the EU and the US accounting for 79.2% and 11.5% of that, respectively. This upward trend is forecast to continue, with environmental, social and governance (ESG) assets on a pathway to exceed $53 trillion globally by 2025, which would represent more than a third of the anticipated $140.5 trillion of global assets under management.

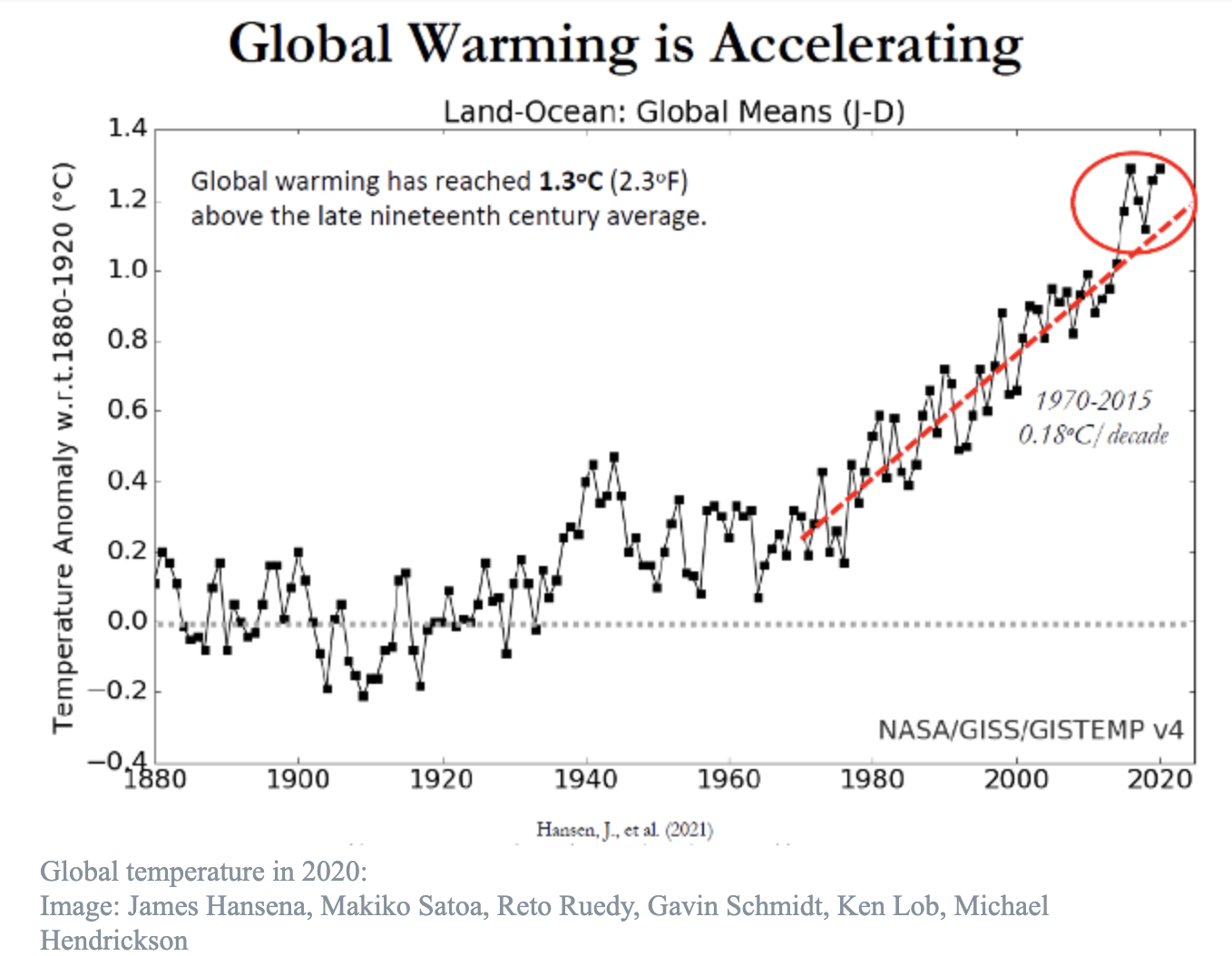

Despite these promising shifts in investment appetite, global warming in 2020 reached 1.3° Celsius above the pre-industrial average, even though global emissions fell by 6.4% or 2.3 billion tonnes due to COVID-19. While this trend is not surprising given greenhouse gas emissions (GHG) can remain in the atmosphere for hundreds of years, this trend does highlight the importance of the world’s progress towards net zero.

Given a lack of standardization on what constitutes an ESG investment, many global sustainable funds, which totaled 4,524 in number as of the first quarter of 2021, repackage traditional investment assets that may not directly contribute to tackling climate change. Although the EU and US are starting to develop and adopt regulations, they are still several years away until robust ESG standards and policies are enforced in the financial sector.

In the meantime, how can investors ensure that their capital is prudently used to build a cleaner and more sustainable world?

1. Incorporation of greenhouse gas emissions reduction targets directly into a fund’s investment thesis and processes

In order to reach net-zero emissions, we must deploy tens of trillions of dollars globally into climate solutions, including the development and commercialisation of technologies focused on large-scale decarbonisation. Despite this, the majority of global sustainable fund investment flows have been into publicly traded equities, including companies that set net-zero targets yet still contribute significantly to emissions.

Some ESG funds are designed with a “negative screen” to exclude certain industries such as fossil fuels and tobacco, while other funds may integrate material ESG factors into their investment processes. Even fewer funds directly integrate quantifiable and verifiable GHG reduction targets into their investment theses.

There is a nascent but growing number of climate venture philanthropy, venture capital and private equity funds that are making these commitments. Private investment funds that invest over long duration horizons can take a proactive approach. These funds invest in companies that have enormous commercial viability and develop disruptive technologies, which can result in substantial and measurable emissions reductions.

The US early-stage climate tech fund, Prime Impact Fund, only considers funding startups that could achieve a gigaton scale GHG emissions reduction cumulatively by 2050. In the EU, Ecosia’s early-stage and growth investments aim to save two gigatons of CO2e per year through 2040. At a market-ready stage, US private equity firm FullCycle invests in scalable climate-critical technology and infrastructure that has been commercially proven, and can achieve a “gigaton or better CO2e impact per year at full deployment”, incorporating CO2e returns from their capital invested.

2. Adoption of robust economic- and science-based approaches and tools to assess and measure emissions reduction of investments

In order to deploy capital effectively and efficiently into emissions-reducing climate technologies, we will need standardised approaches and tools to assess and measure the emissions reduction and market adoption potential of nascent technologies.

Leading early- and growth-stage funds have been using both economic- and science-based approaches to screen potential climate technology investments. For example, Prime uses Emissions Reduction Potential (ERP) assessments to evaluate early-stage climate investments for climate impact potential. FullCycle uses a proprietary Carbon Return on Investment 20 (CROI-20) metric, which introduces carbon as an investment metric to assess emissions reduction alongside Global Warming Potential (GWP) over 20 years – which highlights the scientific understanding that more potent greenhouse gases will need to be removed in the short term.

Additionally, there are tools that can evaluate emissions-reduction potential alongside investment decisions. Rho AI, with Prime, helped build the Crane Tool, an open-access platform with over 200 technology analysis templates that allows users to customise their own models. The tool allows investors, entrepreneurs and supporting organizations to calculate and communicate the emissions-reduction potential of emerging technologies based on available scientific literature and market adoption rate assumptions.

Clean Energy Ventures has also released a Simple Emissions Reduction Calculator (SERC), which approaches ERP from a unit economics perspective (e.g. amount reduced on a unit basis multiplied by units sold). This enables earlier stage startups to model their emission reduction potential, which helps early-stage investors support the right technologies.

3. Tracking of and reporting on actual emissions reduction achieved, not on alternate claims or estimates

Regulators in the EU and the US are beginning to more closely examine ESG funds, managers and investors – but they are still early in this process. EU fund managers as of March will supposedly need to detail tangible, measurable plans for how they invest in ESG issues under the Sustainable Finance Disclosure Regulation (SFDR). In the US, the Securities and Exchange Commission (SEC) plans to increase examinations into ESG fund managers, though admit there is no SEC “rating” or “score” on ESG labels applied across companies.

Tracking and reporting climate impacts, like emissions reduction achieved, can be a complex process. Existing tools provide a starting point for evaluating emissions-reduction potential of climate technology investments, but currently do not measure actual emissions achieved. This is the next logical step in creating a common framework for climate impact measurement. Industry groups are beginning to convene to standardize emissions reductions measurement and tracking, but more effort is required.

Despite increasing regulations and reporting efforts, there is still leeway for ESG funds to make claims and estimates that may not reflect actual impact on climate change, such as emission reductions achieved. Consequently, investors will need to keep ESG asset managers and funds accountable for tracking and reporting the actual climate impact.

Comments