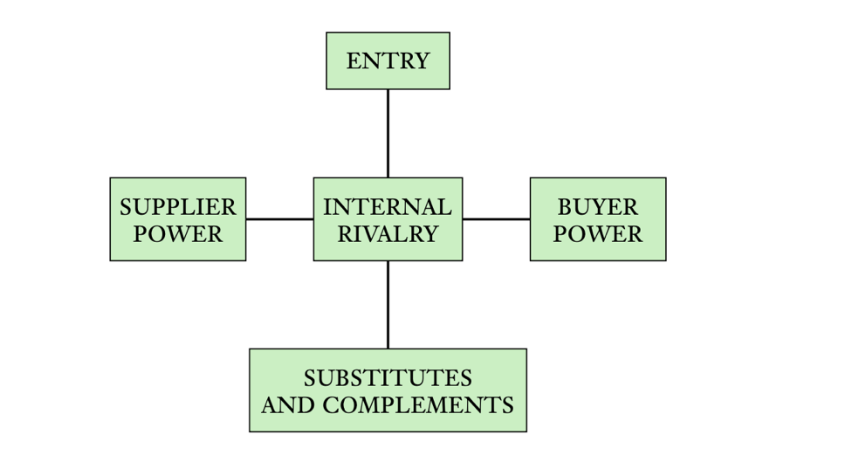

One of the fundamental frameworks necessary to help us understand the economic factors that affect the profits of an industry is Michael Porter’s Five Forces. The Five Forces creates a structure that encompasses a business’s upstream and downstream partners, as well as categorize broad economic issues within an industry. We will be applying the Five Forces to the theme park industry in Orlando, Florida to help us assess the major factors that encompass both external market competition and internal chain of production.

Theme Park Industry Overview

Theme parks are large-scale, immersive attractions with rides, games, and entertainment organized around different themes. They also offer a large variety of goods and services to diversify revenue streams beyond entrance fees. Goods may be broken into categories such as rides, VIP passes, food/drink, clothing/apparel, toys, and other souvenirs. Services may be broken into in-park dining, kiosk attractions such as face-painting, kennel boarding for pets, and nursing facilities. For simplicity, we’ll be focusing on the major parks in the Orlando, Florida area, such as the Walt Disney World Resort, Universal Orlando Resort, SeaWorld Orlando, and Legoland Florida Resort.

Internal Rivalry: Medium

There is a medium risk of competition between existing competitors. Theme parks compete through value propositions, or unique business models, based on owned content. Entertainment franchises are exclusive to each park, so each park has different thematic experiences. For instance, Walt Disney offers princess meet-and-greets, Pirates of the Caribbean-themed rides, and “flights” in a Dumbo-shaped car. Universal offers a Harry Potter universe, the Jurassic Park River Adventure, and Revenge of the Mummy ride. SeaWorld offers ocean life access such as animal performances and aquatic-themed rides.

Since parks differentiate based on distinct entertainment concepts, there is strong brand loyalty, and consumers would likely not be swayed by price alone. Customers on vacation are a captive market and are willing to pay for an enjoyable experience; they may also have a higher spending tolerance than they would at home. Additionally, out-of-town visitors may stay for several days and may visit multiple parks.

Threat of Entry: Low

The threat of new entrants should not be a significant issue. Given that theme parks’ value propositions are based on distinct branding and entertainment concepts, a new entry would need to develop and capitalize on a unique theme that wouldn’t overlap with existing competitors but could still chip into their market share. Successfully establishing and publicizing a new theme park, especially in the crowded Orlando market, would require a large investment of funds (both upfront and maintenance costs), human capital, and logistics solutions. These high barriers to entry mean already-operating parks should not be concerned about new competition. Such a park may threaten secondary attractions such as Legoland, but would likely not threaten the two “mega parks” of Disney and Universal.

Bargaining Power of Suppliers: Low

Major theme parks in the Orlando market have reached the scale where they have vertically integrated most of their supply chains. For example, Disney’s Walt Disney Imagineering (WDI) team designs, engineers, and constructs every new park feature. The Walt Disney Company’s investments in WDI may have allowed it to bypass suppliers that may have significant bargaining power over smaller theme parks such as Gatorland. Additionally, Disney’s suppliers on the construction side of the business are closer to raw inputs providers and have less ability to bargain, given that most commodities are interchangeable, or in near-perfectly competitive markets. Other suppliers, such as food and beverage sellers, are limited in bargaining power due to similar vertical integration, from Food Labs at Disney to Gator Kebabs at Gatorland.

Bargaining Power of Buyers: Medium

Buyers have low bargaining power, as prices set by the theme parks are non-negotiable. However, while an individual consumer’s bargaining power is extremely low, consumers as a collective have substantial indirect pricing power. Theme parks are a luxury product, which means that too expensive fees may deter most customers’ willingness to pay, which would thus decrease revenue. Therefore, correct pricing is crucial to maximize theme park profits. Nevertheless, demand for entry at larger-scale parks such as Universal or Disney remains high, given that they are highly attractive destinations, so their operators may have more pricing discretion.

Substitute Products: High

Broadly speaking, substitutes for theme parks are plentiful, as any family-friendly leisure time can be a substitute good. They may include vacation resorts, sporting events, concerts, festivals, national parks, aquariums, zoos, and many other activities. Substitutes for theme parks in Orlando are also abundant. The city is home to Sea Life Aquarium, ICON Park, and Tree Trek Adventure Park, as well as boasting a large downtown and convenient access to nearby beaches. Still, the mega parks in particular offer exclusive access to their franchise branding and can offer a unique experience for children and families who feel strong attachment to the companies’ brands.

Complement Products: High

Complement products for theme parks include any branded products related to the parks’ underlying theme or franchise. For Disney and Universal, that may include toys, games, books, and other souvenirs tied into franchises (such as Frozen and Star Wars for Disney or Harry Potter for Universal). Other complements beyond souvenirs and gifts include amenities such as food, drinks, lodging, and toiletries. These are sold on-site and in nearby stores.

Comments